Beautiful Tips About How To Obtain A Tax Exempt Number

First, you need to contact the department of revenue for your state.

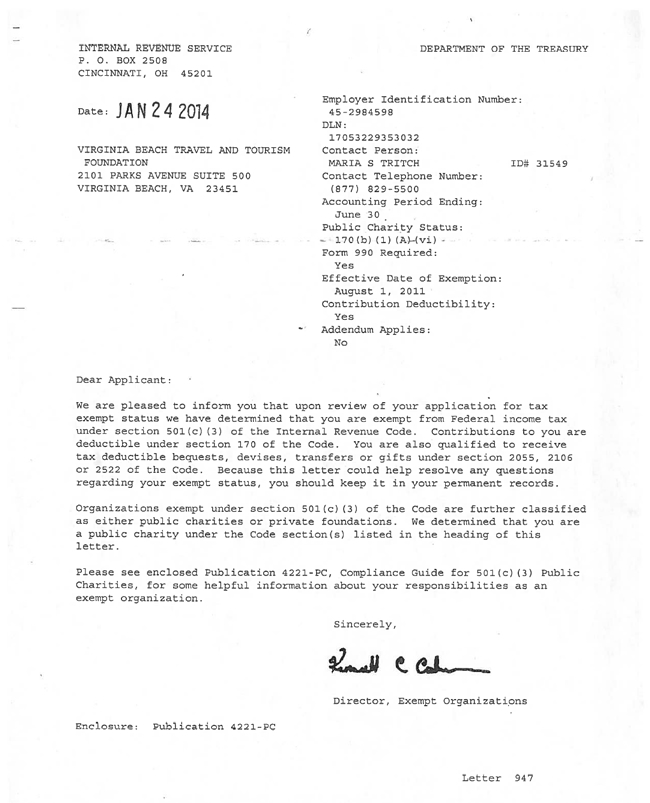

How to obtain a tax exempt number. How do you do it? When approved, the nonprofit will not be required to pay. Nonprofit incorporation creates your nonprofit with your chosen home state.

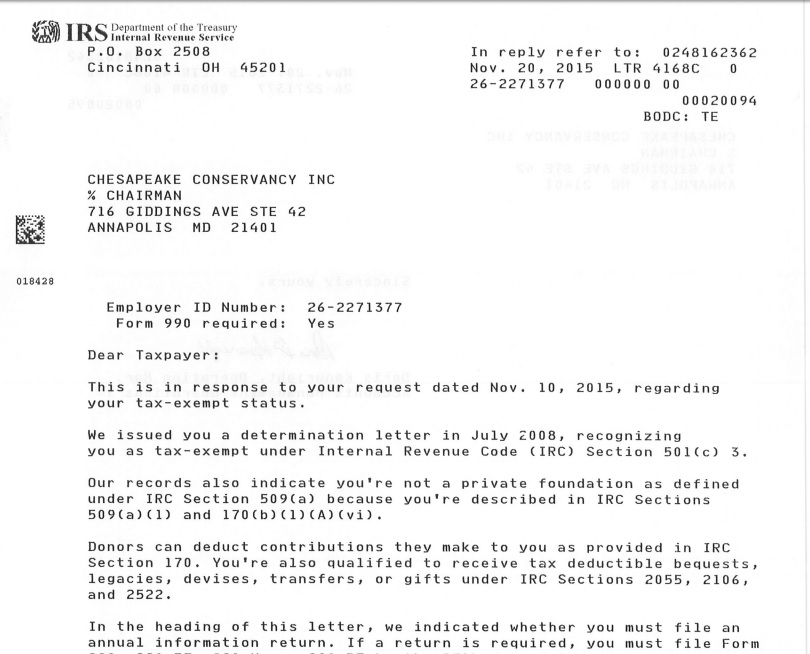

As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. To get the 501(c)(3) status, a corporation must file for a recognition of exemption. Getting a business tax exempt number is actually fairly simple and can be done in 4 steps:

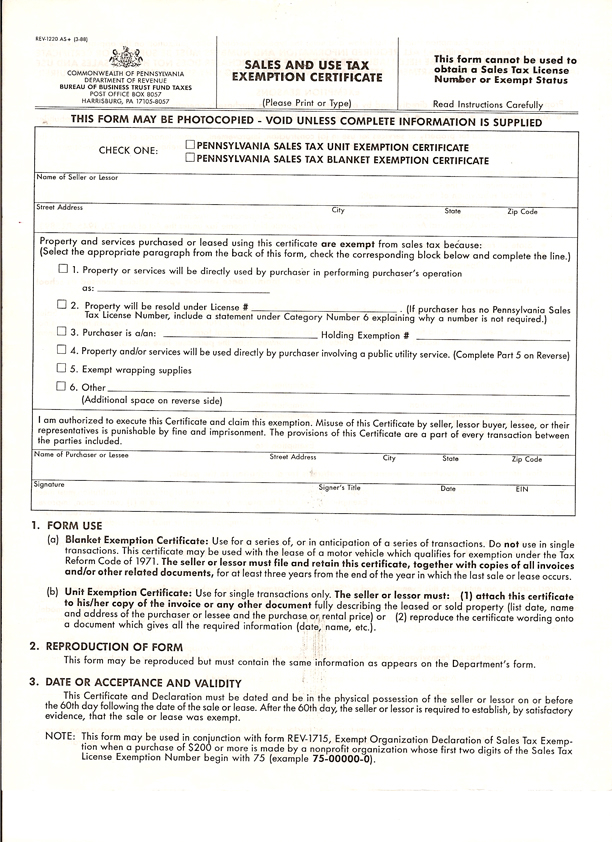

How do i obtain a sales tax exemption number. This is known as nexus, which describes the connection you. Charities and nonprofits.

How do i get an employer identification number (ein) for my. For scholarship and job/livelihood programs. You may apply for an ein online if your principal business is located in the united states or u.s.

To be considered as an. You can apply for an ein online, by mail, or by fax. However, the organization may also wish to.

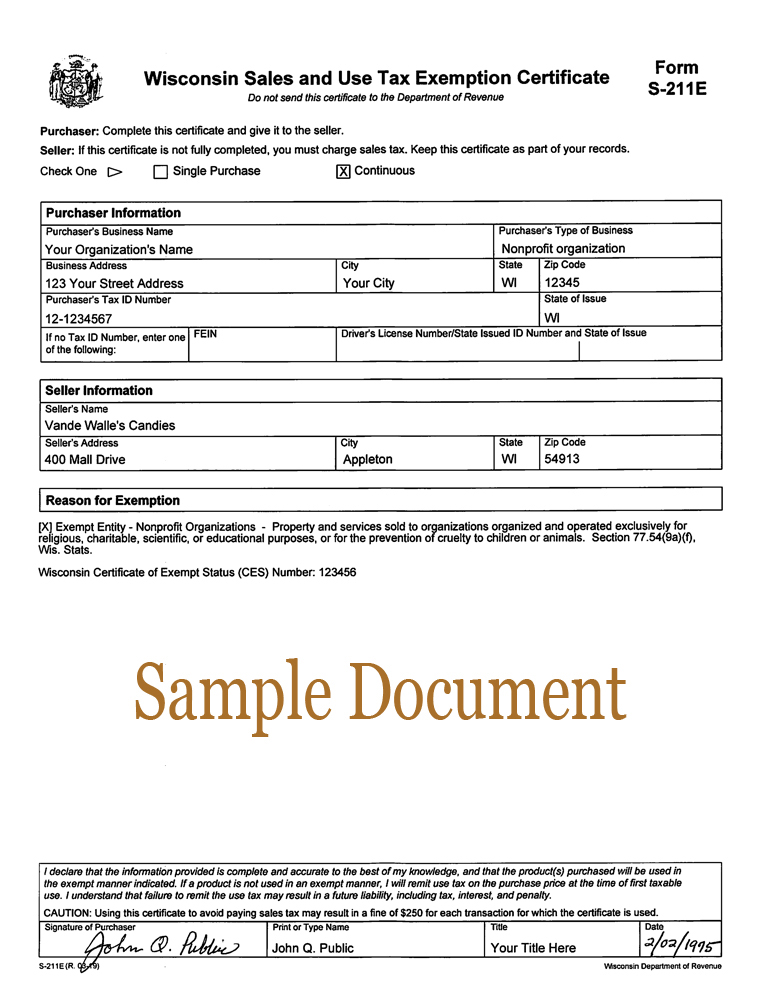

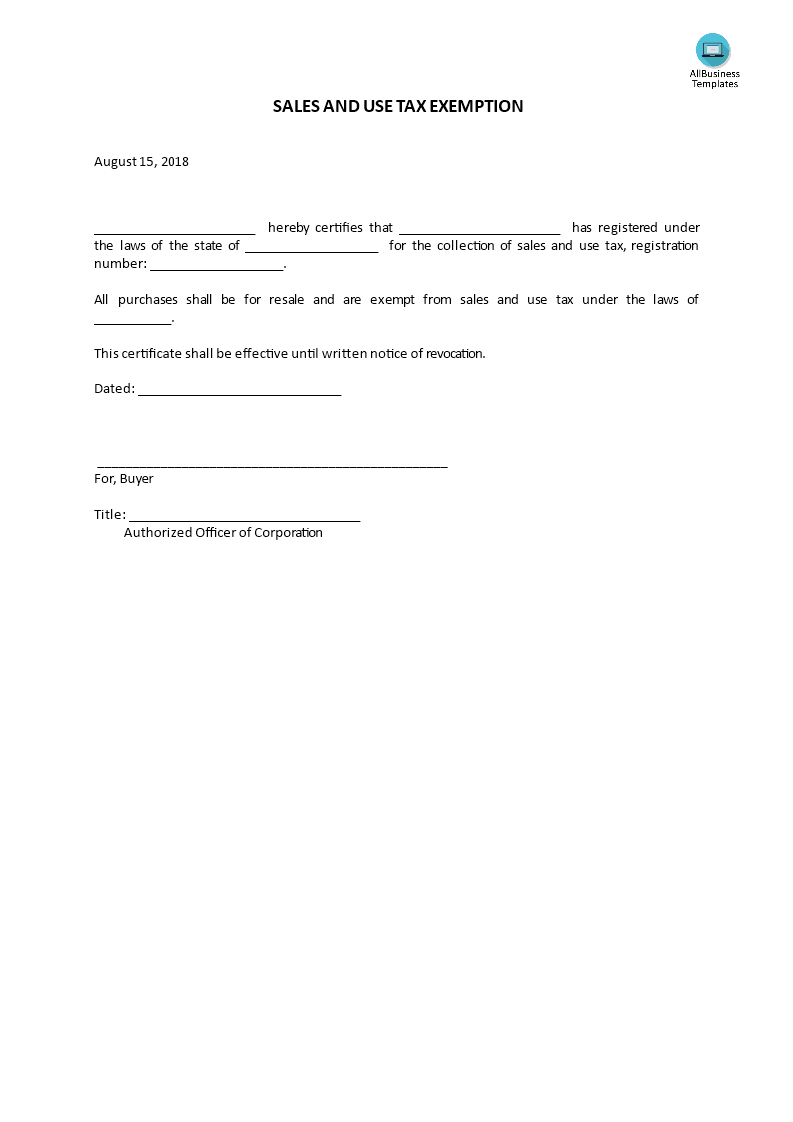

If you are a tax exempt organization and do not have a staples tax exempt customer number, please follow. How do i obtain a staples tax exempt customer number? Keep the copy of the certificate on file.

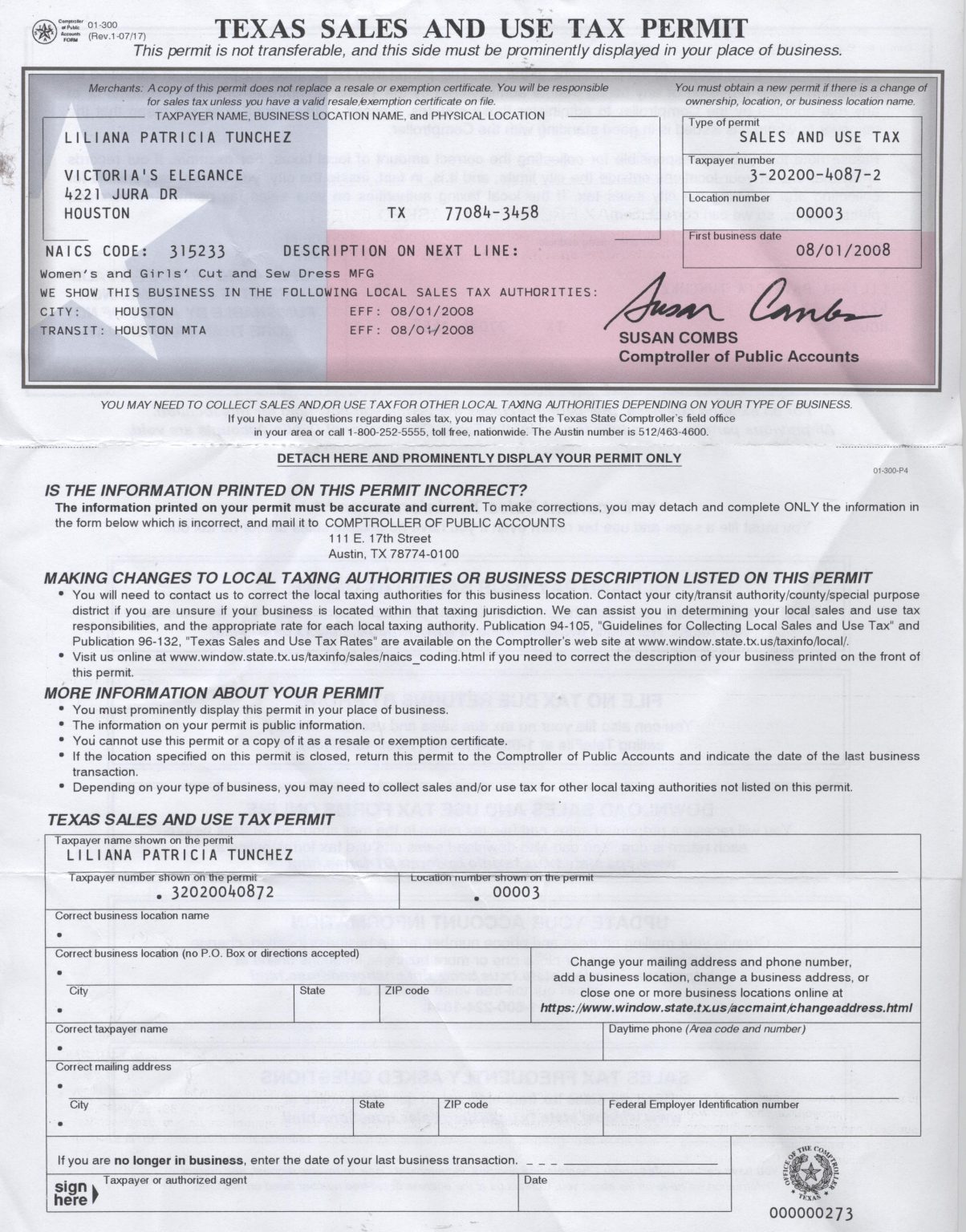

Sales and use tax forms and certificates. Obtaining an employer identification number for an exempt organization. Where to get a certificate of tax exemption?

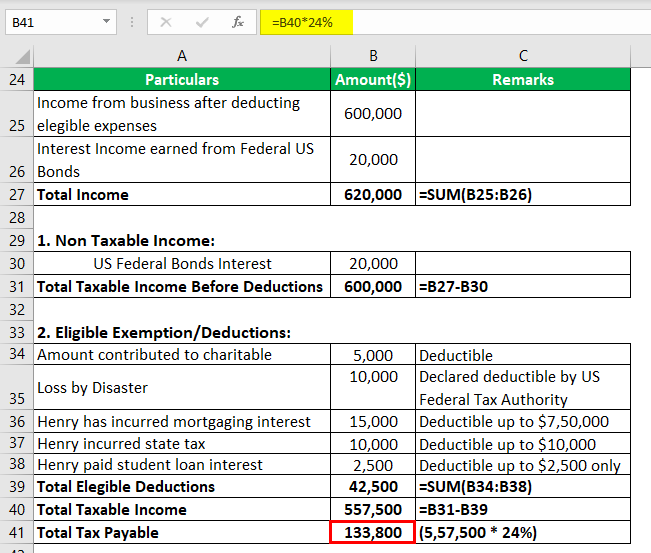

1) develop and organize your business. To qualify as exempt from federal income tax, an organization must meet requirements set forth in the internal revenue code, or irc. You need a tax exempt number, and for that you need to apply for a tax exempt certificate.

The tin later gets exempt status upon. First, identify the states in which you intend to conduct business that requires the sale tax exemption.